Archives for September 2021

Weekly Market Report

For Week Ending September 4, 2021

For Week Ending September 4, 2021

Mortgage rates remained below 3% for the eighth week in a row, with Freddie Mac reporting the 30-year fixed-rate mortgage averaged 2.87% for the week ending September 2nd. Despite persistent low rates, total mortgage applications fell 1.9% compared to the previous week, according to the Mortgage Banker’s Association, with both purchase and refinance applications moderating, as a rise in new COVID-19 cases tempered economic momentum.

In the Twin Cities region, for the week ending September 4:

- New Listings decreased 16.1% to 1,470

- Pending Sales decreased 21.2% to 1,303

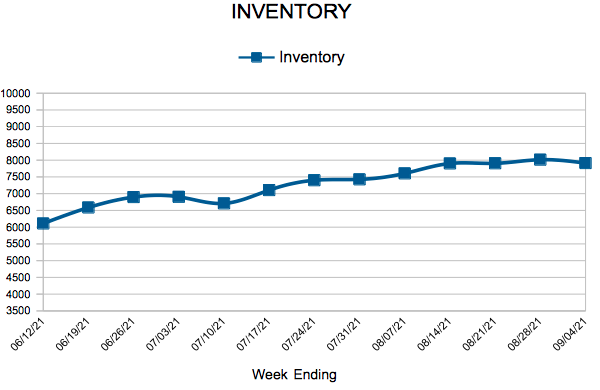

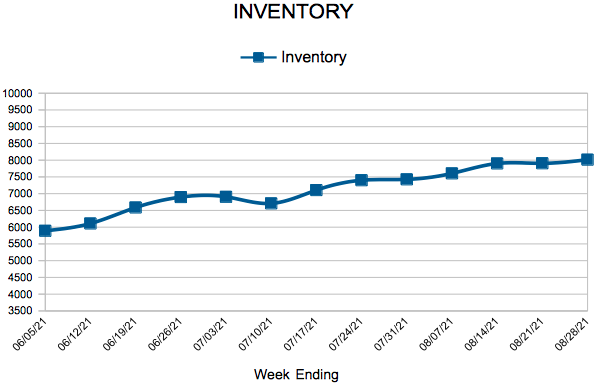

- Inventory decreased 17.7% to 7,913

For the month of July:

- Median Sales Price increased 11.9% to $350,000

- Days on Market decreased 53.7% to 19

- Percent of Original List Price Received increased 3.5% to 103.6%

- Months Supply of Homes For Sale decreased 30.0% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

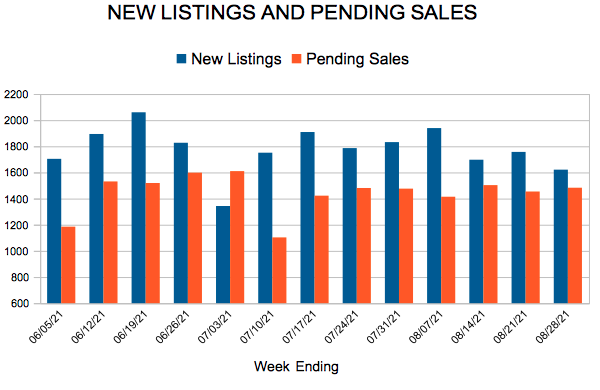

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending August 28, 2021

For Week Ending August 28, 2021

Pending sales were down for a second straight month, falling 1.8% in July, according to the National Association of REALTORS®, as stiff competition for homes and high sales prices have discouraged some would-be buyers. Home prices have been soaring during the pandemic, with the S&P Corelogic Case-Shiller national home price index reporting that prices rose 18.6% nationally in June, the largest annual increase in the history of the index since 1987.

In the Twin Cities region, for the week ending August 28:

- New Listings decreased 10.6% to 1,621

- Pending Sales decreased 8.6% to 1,463

- Inventory decreased 17.8% to 8,014

For the month of July:

- Median Sales Price increased 11.9% to $350,000

- Days on Market decreased 53.7% to 19

- Percent of Original List Price Received increased 3.5% to 103.6%

- Months Supply of Homes For Sale decreased 30.0% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.