For Week Ending January 3, 2026

For Week Ending January 3, 2026

The National Association of REALTORS® (NAR) forecasts a 14% increase in existing-home sales in 2026, alongside a 5% rise in new-home sales. These gains are being fueled by steady job growth, softening mortgage rates, and improving overall market conditions. Home prices are projected to grow 4% this year, reflecting sustained demand and ongoing inventory constraints.

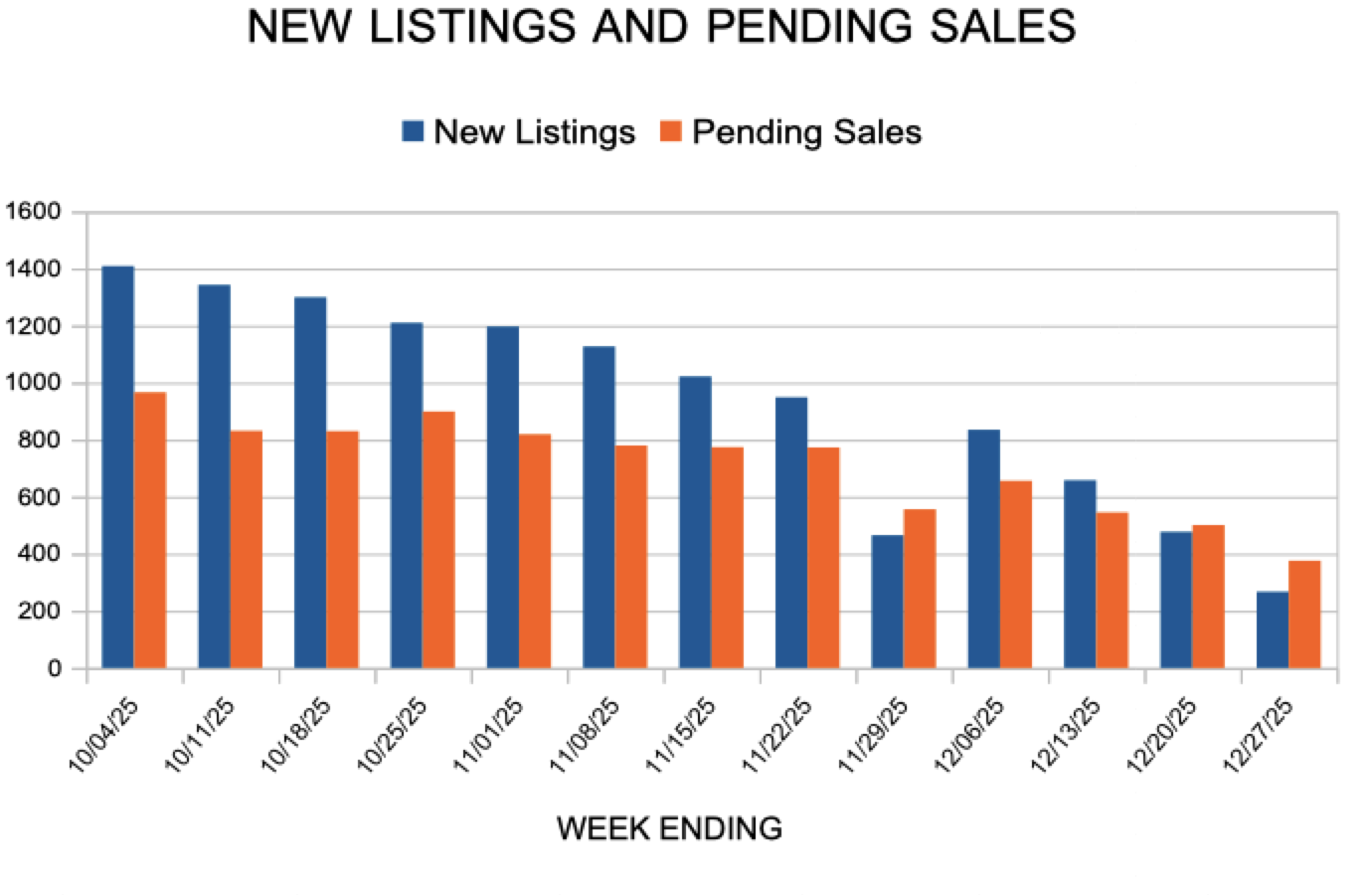

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 3:

- New Listings decreased 18.9% to 586

- Pending Sales decreased 11.8% to 387

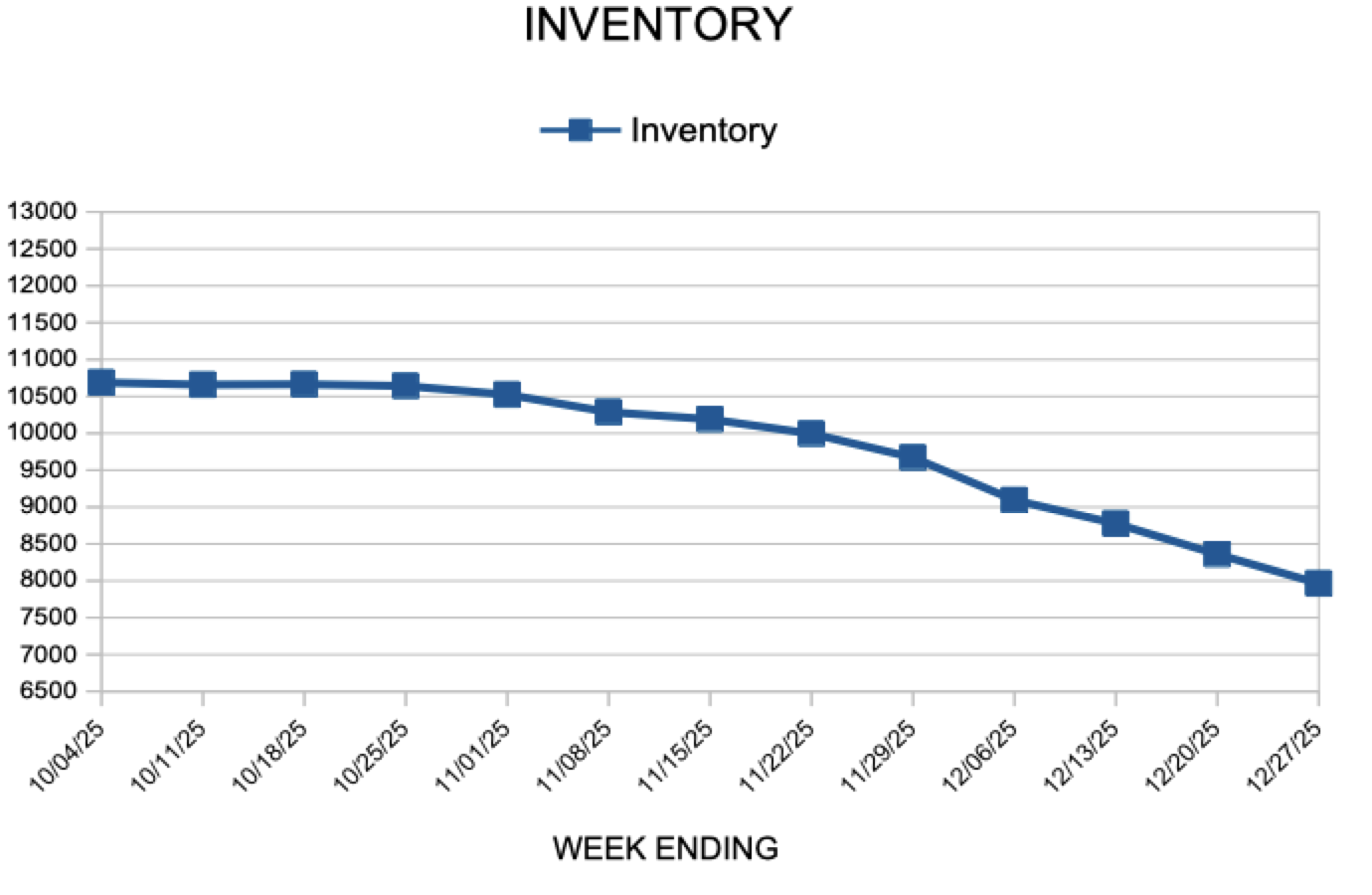

- Inventory decreased 2.6% to 7,683

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.9% to $387,000

- Days on Market remained flat at 50

- Percent of Original List Price Received decreased 0.2% to 97.4%

- Months Supply of Homes For Sale remained flat at 2.5

All comparisons are to 2025

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.