Weekly Market Report

For Week Ending September 6, 2025

For Week Ending September 6, 2025

U.S. housing starts rose to a five-month high, climbing 5.2% month-over-month and 12.9% year-over-year to a seasonally adjusted annual rate of 1,428,000 units, according to the U.S. Census Bureau. The gain was driven primarily by multi-family starts, which surged 11.6% from the previous month to 470,000 units, while single family starts increased 2.8% to 939,000 units.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 6:

- New Listings increased 8.2% to 1,574

- Pending Sales increased 6.5% to 825

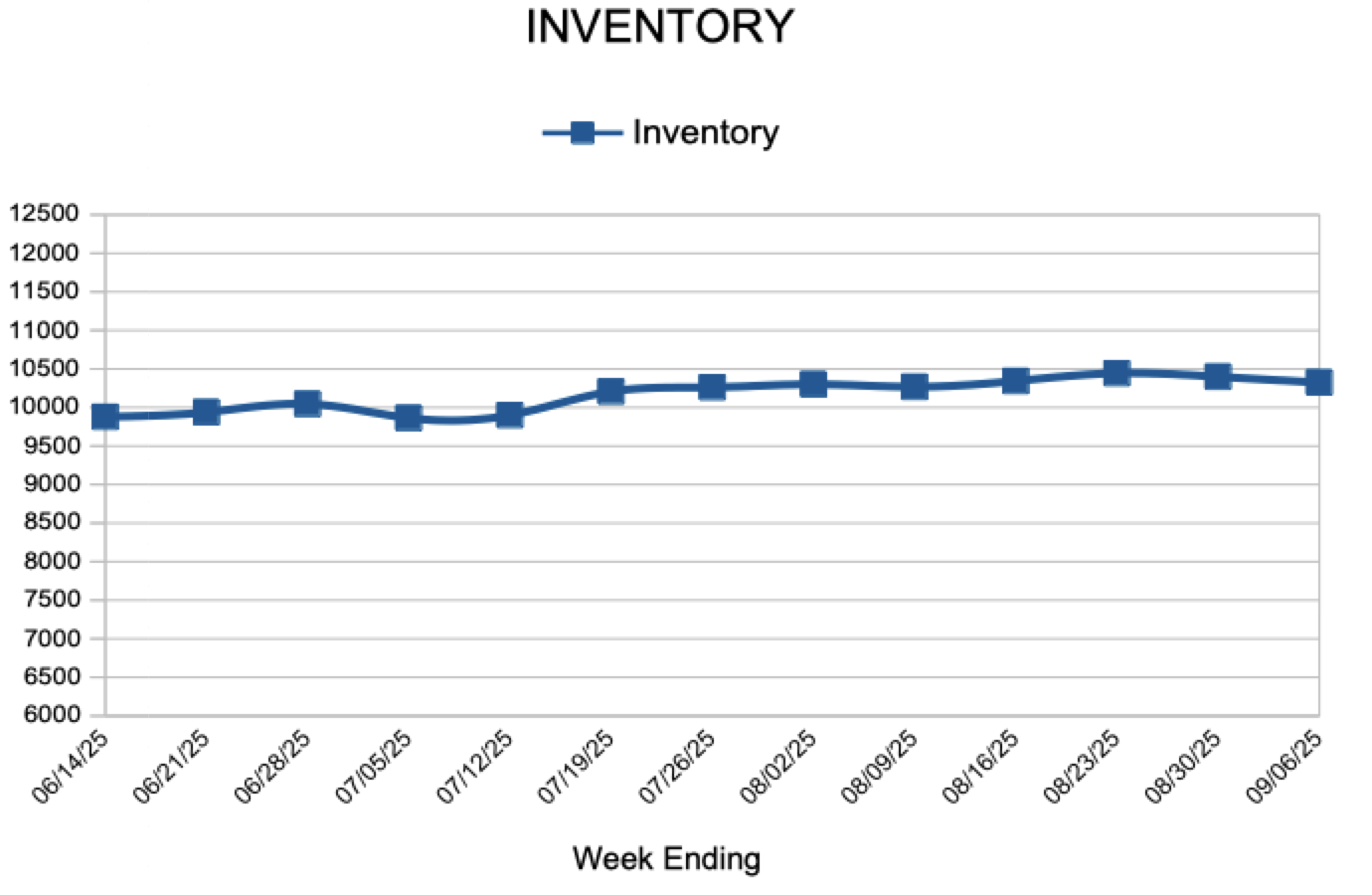

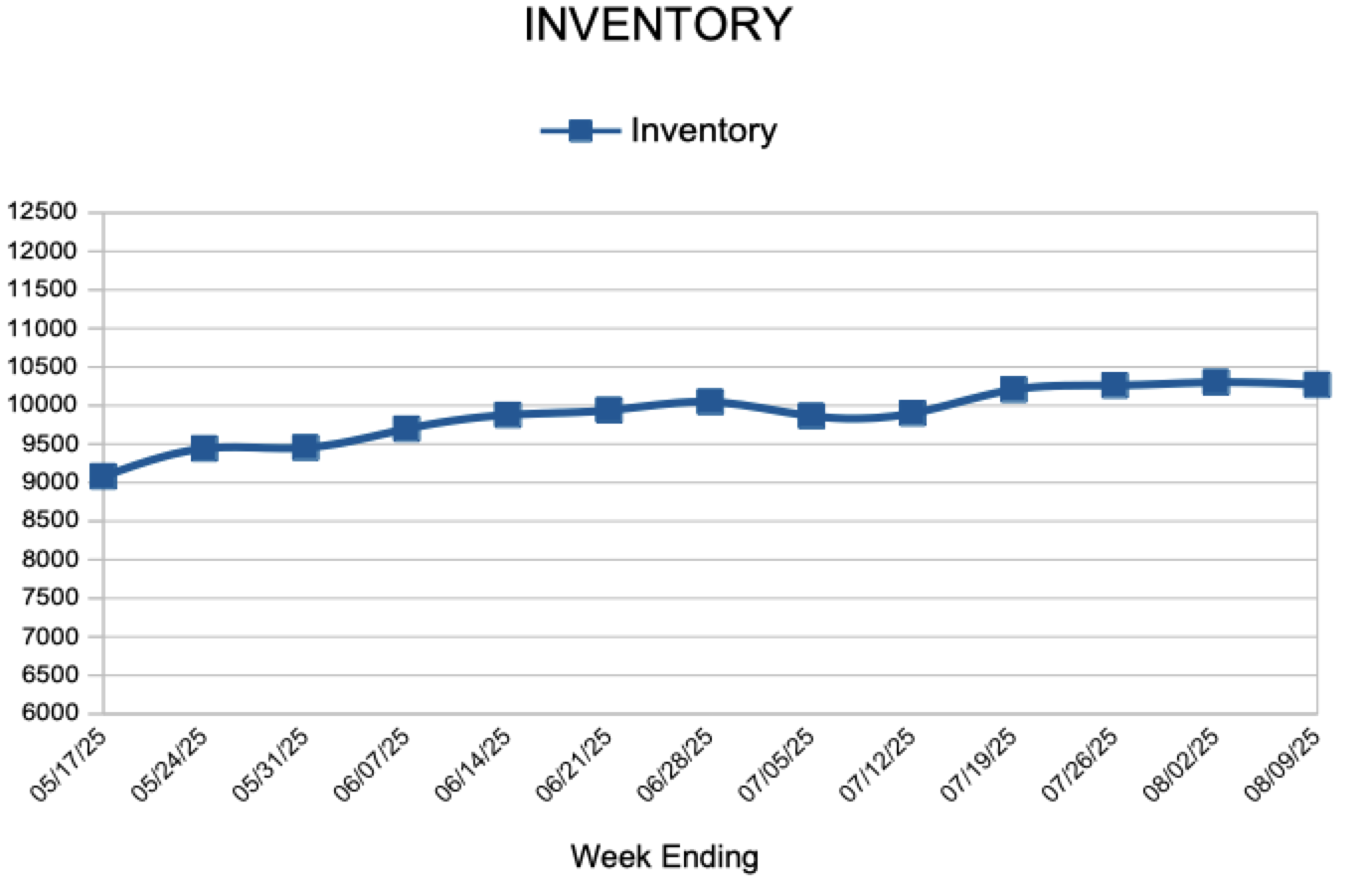

- Inventory increased 1.4% to 10,325

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.8% to $399,999

- Days on Market increased 5.0% to 42

- Percent of Original List Price Received remained flat at 98.7%

- Months Supply of Homes For Sale decreased 3.6% to 2.7/li>

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Inventory

Inventory

Weekly Market Report

For Week Ending August 16, 2025

For Week Ending August 16, 2025

At present, 62% of Americans own a home, while 34% say they rent, according to a recent Gallup survey. Among non homeowners, 30% plan to purchase a home within the next five years, 23% plan to do so within the next ten years, and 45% have no plans to buy a home in the foreseeable future. Renters say the cost of homeownership, including a down payment, is the greatest barrier to purchasing a home.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 16:

- New Listings increased 9.2% to 1,466

- Pending Sales increased 6.8% to 1,007

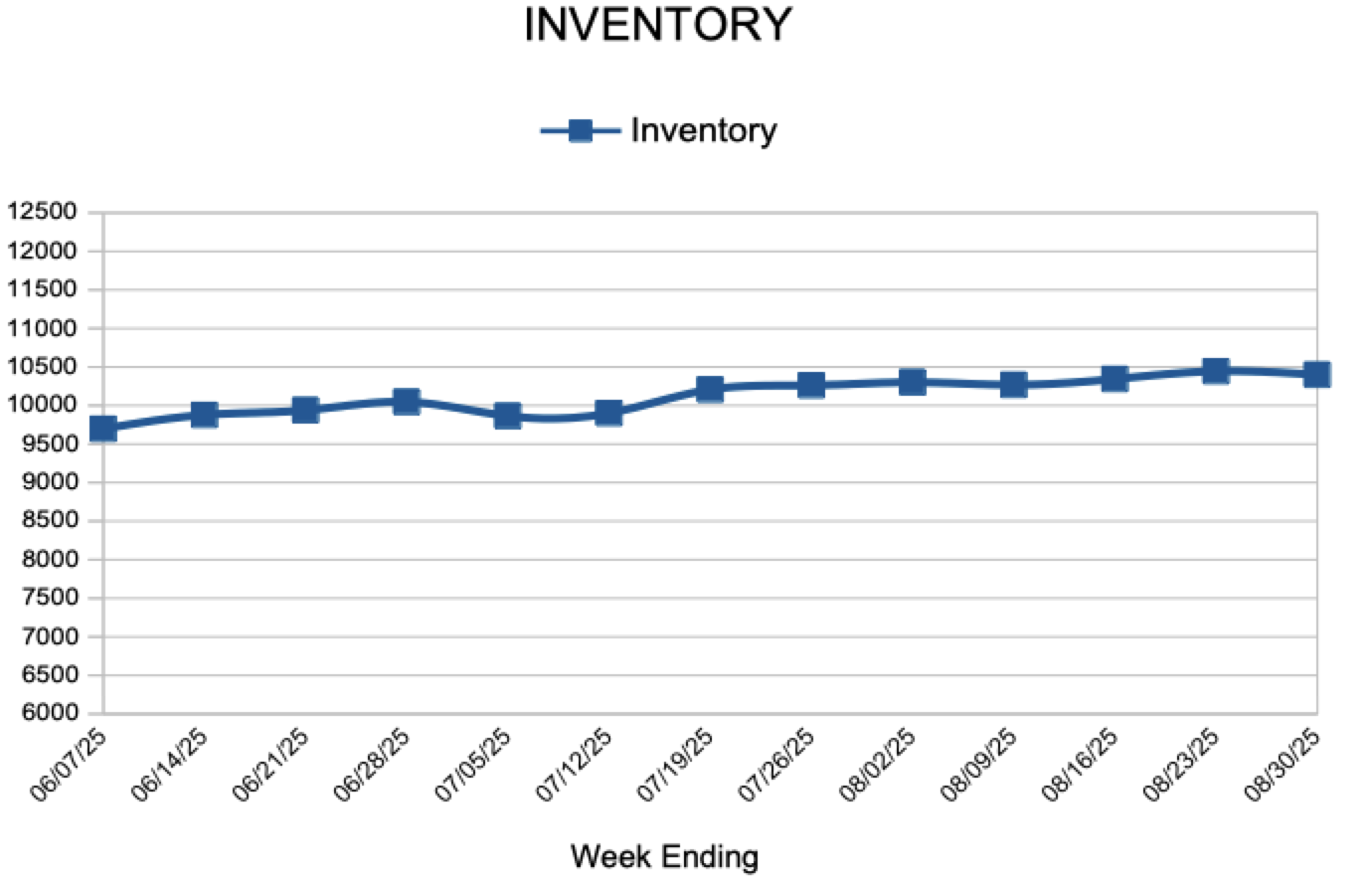

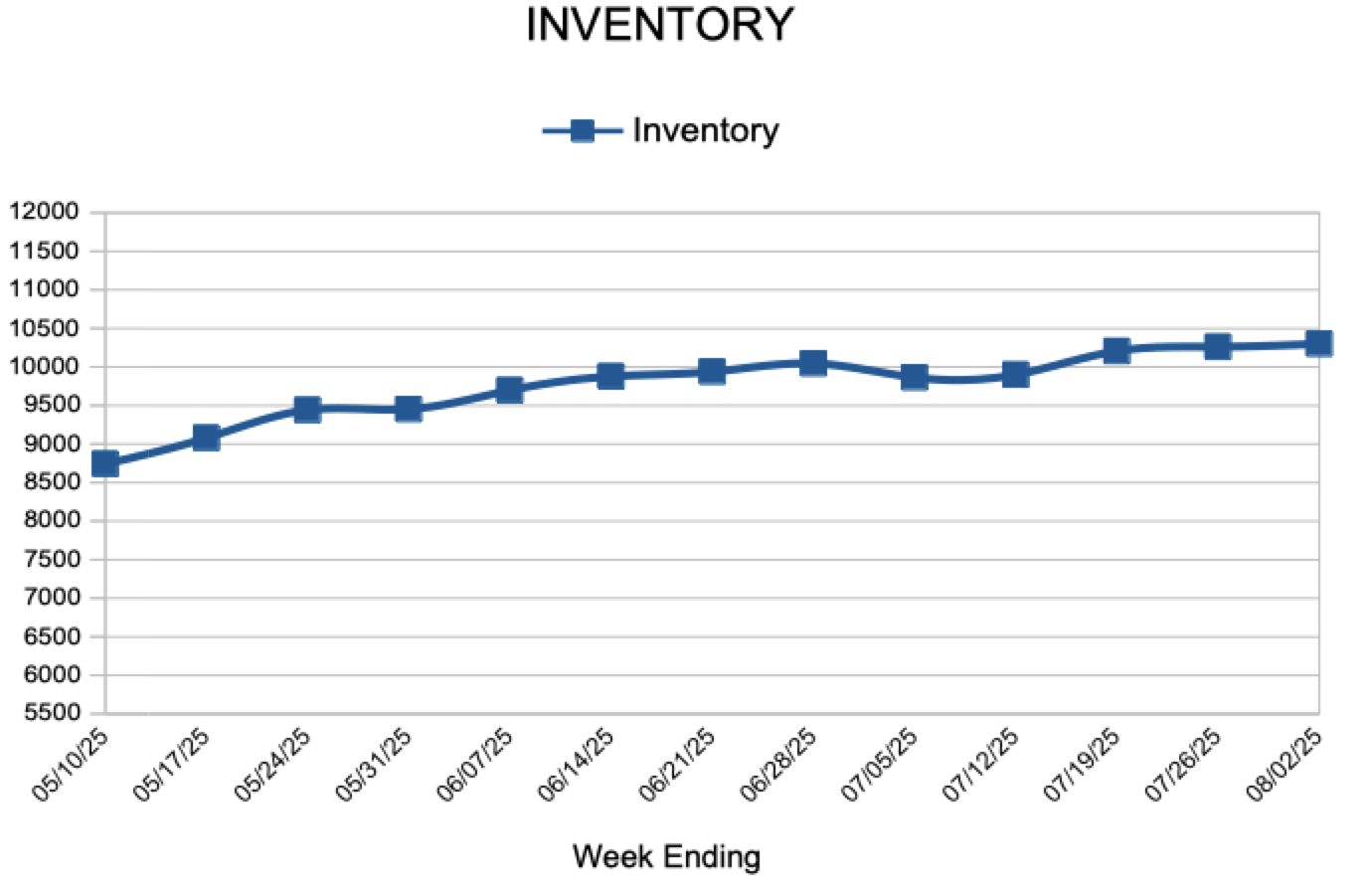

- Inventory increased 1.0% to 10,344

FOR THE MONTH OF JULY:

- Median Sales Price increased 2.6% to $395,000

- Days on Market increased 11.1% to 40

- Percent of Original List Price Received decreased 0.2% to 99.3%

- Months Supply of Homes For Sale remained flat at 2.7

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending August 9, 2025

For Week Ending August 9, 2025

The average monthly mortgage payment on a median-priced home reached a record high of $2,570 in 2024, based on a 30-year fixed-rate loan and a 3.5% down payment, according to the State of the Nation’s Housing 2025 report from Harvard University’s Joint Center for Housing Studies. Using a 31% debt-to-income ratio, a homebuyer would need to earn at least $126,700 per year to afford that monthly payment.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 9:

- New Listings decreased 6.9% to 1,408

- Pending Sales increased 8.5% to 1,005

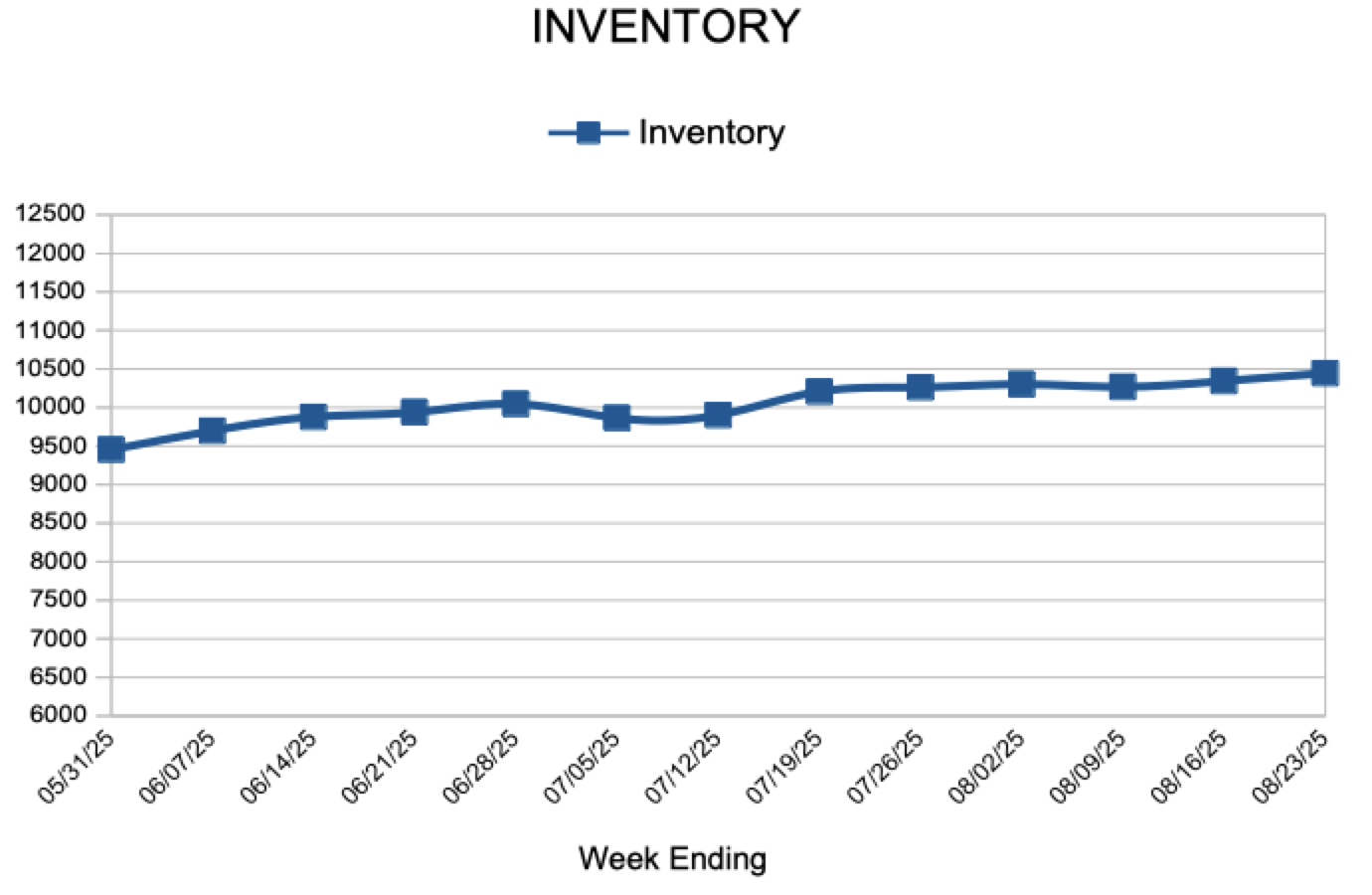

- Inventory increased 2.2% to 10,268

FOR THE MONTH OF JULY:

- Median Sales Price increased 2.6% to $395,000

- Days on Market increased 11.1% to 40

- Percent of Original List Price Received decreased 0.2% to 99.3%

- Months Supply of Homes For Sale remained flat at 2.7

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending August 2, 2025

For Week Ending August 2, 2025

U.S. housing starts rose 4.6% month-over-month to a seasonally adjusted annual rate of 1,321,000 units, according to the U.S. Census Bureau. Single-family housing starts decreased 4.6% from the previous month to a seasonally adjusted annual rate of 883,000 units, while multi-family starts jumped 30.6% to 414,000 units.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 2:

- New Listings increased 2.0% to 1,514

- Pending Sales decreased 8.3% to 979

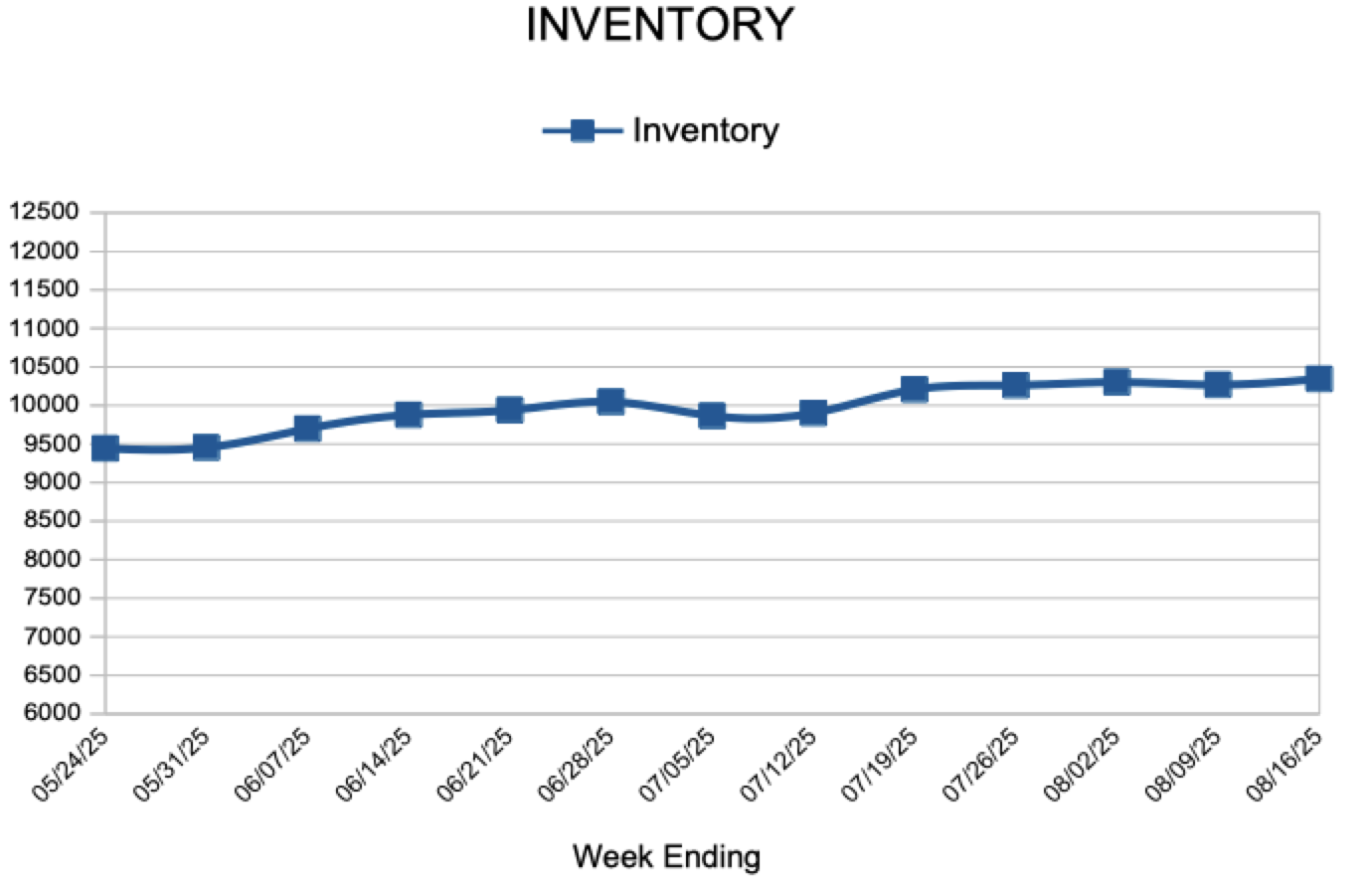

- Inventory increased 3.4% to 10,301

FOR THE MONTH OF JUNE:

- Median Sales Price increased 2.8% to $401,000

- Days on Market increased 11.4% to 39

- Percent of Original List Price Received decreased 0.1% to 100.0%

- Months Supply of Homes For Sale increased 4.0% to 2.6

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- 1

- 2

- 3

- …

- 44

- Next Page »