November 17, 2022

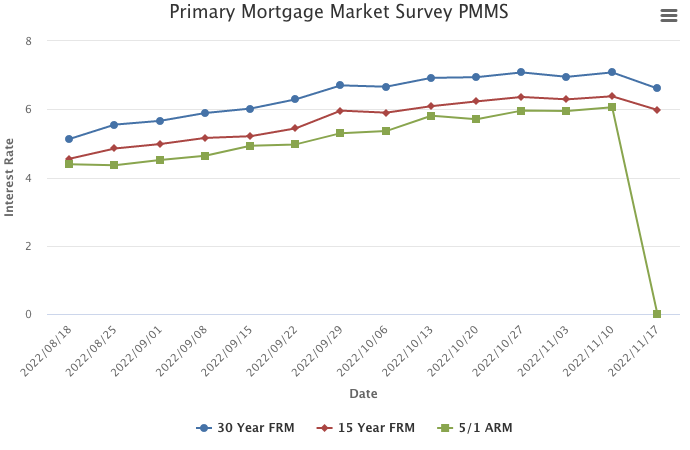

Mortgage rates tumbled this week due to incoming data that suggests inflation may have peaked. While the decline in mortgage rates is welcome news, there is still a long road ahead for the housing market. Inflation remains elevated, the Federal Reserve is likely to keep interest rates high and consumers will continue to feel the impact.

Over the last fifty years, Freddie Mac has closely monitored the trajectory of mortgage rates. This week we are launching enhancements to our Primary Mortgage Market Survey® methodology that will increase its accuracy and reliability. This new approach will incorporate more detailed data and monitor real-time mortgage rates more closely.

Information provided by Freddie Mac.